CA-I Assignment on Global Trends & Management Issues

Part A

GLOBALIZATION FUTURE SCENARIOS

New Trading Bloc (China Russia)

One of the most critical potential developments in globalization is the formation of a new trading bloc led by China and Russia. This new alliance is based on both economic interests and geopolitical objectives. The West's sanctions on Russia, after it annexed Crimea in 2014 and continues to conflict with Ukraine, have isolated Russia from Western markets (Rabinovych and Pintsch, 2024). Therefore,Russia’sexpectations have increased from China, which it has used as an alternative in terms of trade and investment. Likewise, this alliance will help China undermine the US-dominated global order while increasing its Belt and Road Initiative(BRI) project (MacDonald, 2022). This will entail creating infrastructure and trade lines that will connect Asia with Europe and Africa and ultimately place China as the great power of the global economic order.

Resource complementarity supports this alliance, as Russia provides plenty of natural resources, including energy and raw materials. China offers high-tech manufacturing capabilities and technological know-how (Kireeva, 2023). Moreover, Kireeva, (2023) states that politically, the two countries, Russia and China share a common vision of a multipolar world order and are opposed to Western dominance in global governance. Together, they have envisioned reducing their reliance on Western institutions, which include the World Trade Organization (WTO) and International Monetary Fund (IMF), while boosting alternative frameworks such as the Shanghai Cooperation Organization (SCO) and BRICS. Furthermore, the technological landscape would also be drastically changed with the formation of a new trading bloc between China and Russia. According to Bo (2023),China and Russia are both focusing on the development of indigenous technologies that reduce their dependence on Western suppliers. This focus might increase competition in areas like artificial intelligence, renewable energy, and semiconductors.

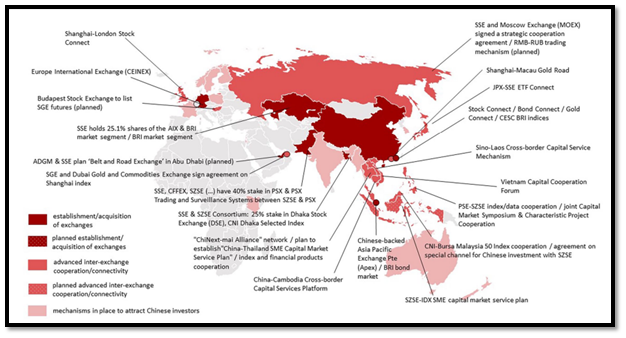

Figure 1: An emerging patchwork of Chinese financial infrastructures (Source: Petry, 2023)

Figure 1 identifies emerging Chinese financial infrastructural development initiatives. Petry,(2023) determines thatfurther implications for global investment patterns include the increasing engagement of developing nations including Africa, Asia, and Latin America towards China and Russia for infrastructure financing and market access. As a result, the emerging powers may gain new opportunities in trade but also may fall into economic dependency on the bloc. However, Krickovic and Pellicciari, (2021) state that Western economies, especially the US and the EU, would struggle to maintain their influence after China and Russia alliance. The mentioned study identifies access to markets and resources in line with the China-Russia bloc would be diminished, which could slow down innovation and economic growth. The smaller nations would feel pressure to take sides, limiting their ability to participate in multilateral trade.

Peace between Russia and Ukraine

Peace would re-establish stability in world trade and supply chains, mainly in key sectors such as agriculture and energy. Hellegers(2022) states that Ukraineis one of the world's biggest grain and other staple exporters. It is determined that establishing peace between Ukraine and Russia would revivethe global markets and consequently solve food insecurity in the developing world. Moreover, Russia is the world’s second-largest oil producer and hasthe largest natural gas reserves (Hellegers, 2022).Therefore, lifting sanctions on Russia could integrate it back into the world economy, providing a route to its massive deposits of oil, gas, and minerals.

According to Mbah and Wasum,(2022) for Europe, peace would be the way out of economic recession. It could then focus on consolidation and strengthening its markets through investment attraction and innovation development. A stable Europe regains its position as an influential player in globalization resulting in multi-lateral cooperation becoming important, and integration, through the revival of previously exploited trade routes, such as the Silk Road through Eurasia, for the smooth transportation of goods and services.

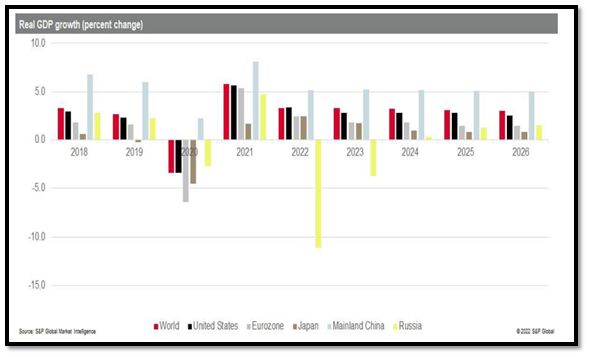

Figure 2: Real GDP growth (Source: Tank and Ospanova, 2022)

Figure 2 represents the real GDP growth during and after war prediction in the peace scenario. The global real GDP growth in 2022 has marked down to 3.3% from 4.1% in the previous year. On a broader scale, peace would reduce geopolitical tensions and restore confidence in global institutions like the WTO (Tank and Ospanova, 2022). Multilateralism, which the conflict has undermined, could regain traction, allowing cooperative solutions to global challenges such as climate change and technology governance.

Moreover, Khudaykulova, Yuanqiong, and Khudaykulov(2022) determine that developing nations will also benefit significantly from peace between Russia and Ukraine conflict. The stabilization of energy prices would ease economic pressures for import-dependent countries, and renewed trade opportunities with Europe would spur economic growth. Moreover, rebuilding efforts in Ukraine will open up the country to international businesses through infrastructure development, technology, and finance. Furthermore, peace can also change the China-Russia relationship dynamics (Mbah and Wasum, 2022). Without the pressure of Western sanctions, Russia may look to rebuild its ties with Europe, reducing its dependence on China. This could potentially weaken the China-Russia bloc and reshape the geopolitical landscape.

Effects on Globalization

A China-Russia trading bloc represents a model of fragmented globalization. Lavery and Schmid,(2021) provide that the China-Russia trading blocwill polarize trade systems and fragment them into regional blocs, thereby disrupting the fluidity of goods, services, and technology. A new multipolar trade environment, in which nations align their positions with either Western economies or the China-Russia bloc, would emerge in this scenario. Such a fragmented structure decreases overall efficiency because transaction costs increase and involve overlapping and conflicting standards for trading and investments. The China-Russia bloc is promoting alternative mechanisms for financial transactions that do not rely on the US dollar (Aksenov et al., 2023). Trade agreements settled in local currencies or initiatives like the BRICS New Development Bank would be examples. De-dollarization, although beneficial to nations aligned with the bloc, would destabilize global financial markets by weakening the US dollar's role as the world's reserve currency.

Effects on Other Countries

Increasing investment should be a boon to third-world countries under the guidance of China's Belt and Road Initiative. Many nations have soughtthe benefits of various infrastructure development projects, aiming towards improving connectivity and also for economic growth (Kazantsev, Medvedeva, and Safranchuk 2021). However, Fernando(2022) states that the existence of debt dependency with concomitant loss of sovereignty, as in Sri Lanka's Hambantota Port. Countries participating may have reduced access to markets of the West limiting opportunities for exports and consequently advanced technology. Moreover, Kazantsev, Medvedeva, and Safranchuk(2021) identify that the EU and US would have increased competition with the bloc, particularly in Africa and Central Asia where China and Russia have greater influence. This may reduce access to Western businesses into markets within the bloc and compel them to be accommodative to other competing trade and regulatory standards. Therefore, global market stability would lower the energy and food price volatility, helping resource-poor developing nations. Importing wheat and other staple foods would become less stressful for African and Middle Eastern countries.

Part B

Scenario 1: Emergence of a Divided Global Economy

The first scenario reflects the full realization of a fragmented globalization model. In this scenario, the world is divided into two clear economic blocs: one led by China and Russia and the other dominated by the US, EU, and their allies. The two blocs function with separate trade frameworks, financial systems, and technological ecosystems. According to Bhambra(2020),the emergence of a divided global economyposes great challenges for business operations. The mentioned study determines that a firm that operates globally will be operating in two systems at one time, whether that's regulatory standards or the kind of technological platforms they may employ. Furthermore, Barai and Dhar,(2024) state that Supply chains, already stressed by geopolitical tensions and the COVID-19 pandemic, would further fragment, forcing companies to develop regional supply chains to manage risks. On the financial side, currency risks and transaction complexities may become a concern for businesses as de-dollarization gains momentum (Falarti and Naqvi, 2024). The mentioned study also points out that the rise of alternative financial systems under BRICS, can weaken the dollar's position and pose a threat to firms involved in dollar-based trade and investments.

The divided economy would imply competing technological standards; thereby, businesses would need to invest in more systems than one. On the other hand, multilateralism encourages international collaboration in innovation, such as renewable energy and digital technologies (Hattori, Nam, and Chapman, 2022). Regionalization strikes a balance between innovation and customization within regions, creating niche markets for localized technologies. In the world of fragmentation, firms need to deal with fewer markets and more barriers to trade. Peace and multilateralism reduce trade costs and unlock new opportunities. Regionalization engenders deeper integration within regions but reduces the range for international expansion.

Scenario 2: Restoration of Multilateral Globalization Post-Peace in Ukraine

Thescenario of establishing peace between Russia and Ukraine opens up a path for renewed multilateral globalization. Sanctions on Russia are removed, and Russia is allowed to re-enter the global economy, and reconstruction in Ukraine opens avenues for international cooperation. Trade barriers decrease, and global supply chains stabilize.For business, post-peace in Ukraine situation would present a positive global climate (Belo and Rodríguez, 2023). Russia's readmission into world trade would stabilize the energy markets, thus lowering the costs and increasing predictability for industries dependent on oil, gas, and minerals (Chowdhry et al., 2024). The findings of the mentioned study determined Europe, liberated from geopolitical tensions, would be an investment and innovation hub, opening doors to sectors such as renewable energy, technology, and industrial manufacturing. Therefore, multilateral trade agreements and cooperation would take off, and companies would have easier access to diversified markets with fewer restrictions. Global confidence in institutions such as the WTO and IMF would be restored, making trade and investment flows smoother for multinational corporations and smaller firms seeking to expand internationally.

Scenario 3: Incremental Shift towards Regionalization without Complete Fragmentation

The third scenario foresees a middle ground where globalization neither fully fragments nor fully integrates. Instead, the global order becomes increasingly regionalized as countries prioritize regional trade agreements while maintaining selective engagement in global markets. This scenario could emerge if a China-Russia bloc gets stronger but not strong enough to fully break down hegemony in the West. The West might react in the form of deep regional cooperation, for example by forming the Trans-Pacific Partnership (TPP) and EU-Africa trade agreements.On the other hand, non-aligned nations might continue to adopt independent foreign policies, enjoying the presence of both blocs in their region without fully merging with either.Hsieh, (2023) states that regionalization makes the operations of scale-based firms more complex. Business faces diverse regulatory regimes, trade policies, and standards in technologies that could make globalization inefficient. Additionally, regionalization puts small economies at the risk of being marginalized, with a disadvantage of bargaining power in forming influential trading blocs that will limit access to opportunities for business at a global level. On the other hand,Zhukov and Diugowanets,(2020),regionalization calls for sophisticated market strategies on the part of businesses. Businesses would need to determine which regions hold the most promise for stability and growth but be in a position to switch from one bloc to another as needed. Supply chains will remain regional, not tied to any single country or region. Diversified manufacturing in Southeast Asia, Latin America, and Africa could reduce geopolitical risk, for instance.Regionalization also encourages innovation in regional markets. Therefore, the business firms operating in emerging markets can innovate products and services to fit the needs of a specific region.

Popular Sample

Read Assignment 3's discussion paper to gain valuable insights and thorough analysis on the topic at hand. A must-read for in-depth knowledge....

Delve into cognitive development stages, key theories, and influential factors shaping human intelligence from infancy to adulthood....

Learn why transparency is crucial in digital marketing and how it can improve your brand's credibility and customer engagement....